Introduction

Jewelry is not only decorative but can also be a valuable investment. Gold jewelry, silver jewelry, gemstone jewelry, fine jewelry, and luxury jewelry have long been considered reliable assets. Understanding what to invest in and how to select valuable pieces ensures both aesthetic enjoyment and financial benefit. marcasite

Why Jewelry is a Good Investment

1: Gold Jewelry

Gold jewelry retains value over time due to the scarcity and demand of gold. Classic designs, such as gold rings, bracelets, and necklaces, are both stylish and financially secure.

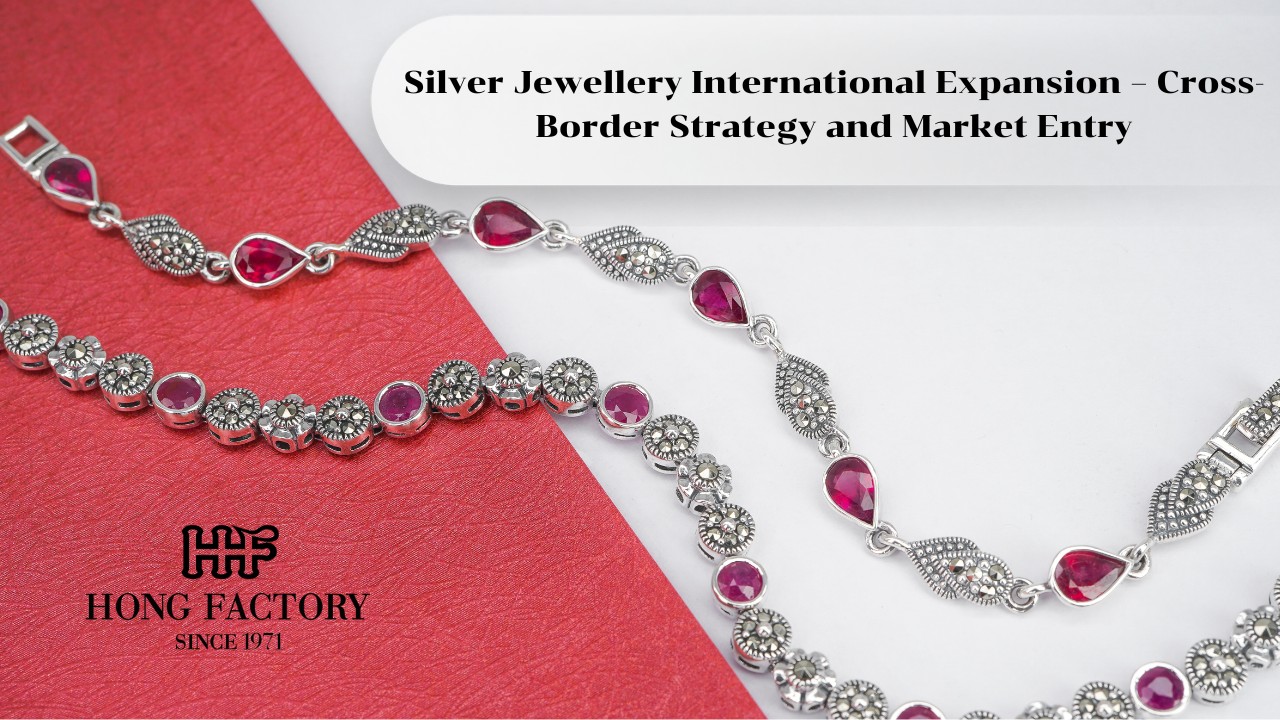

2: Gemstone Jewelry

High-quality gemstones, including diamonds, emeralds, rubies, and sapphires, often appreciate over time. Gemstone jewelry can be worn while also serving as a tangible investment.

3: Luxury Jewelry

Luxury jewelry brands maintain resale value. Rare or limited-edition pieces from reputable makers can significantly increase in worth.

Factors to Consider Before Investing

1: Material Quality

Assess gold purity, gemstone grading, and overall craftsmanship. Fine jewelry and luxury jewelry usually offer the highest quality and value retention.

2: Brand Reputation

Reputable jewelers and luxury brands provide assurance of authenticity and quality, making their pieces desirable for collectors.

3: Timeless Design

Classic and versatile designs maintain appeal longer than trendy fashion jewelry, ensuring long-term value.

How to Invest Safely

1: Certification and Appraisal

Obtain certification for gemstones and professional appraisals for valuable pieces. This ensures authenticity and market value.

2: Proper Storage

Gold jewelry, gemstone jewelry, and luxury jewelry should be stored securely to prevent damage or theft.

3: Diversify Investments

Invest in a mix of metals, gemstones, and luxury pieces. Diversification reduces risk while maintaining style variety.

Benefits of Jewelry Investment

1: Tangible Asset

Jewelry is a tangible asset that combines beauty and financial security. It can be worn, gifted, or resold.

2: Emotional and Sentimental Value

Jewelry can have personal or cultural significance, adding intangible value to financial investment.

3: Portfolio Diversification

Including jewelry in an investment portfolio provides a unique asset class that is less correlated with stocks or real estate.

Conclusion

Investing in jewelry allows for a combination of aesthetic enjoyment, personal expression, and financial security. Gold jewelry, gemstone jewelry, fine jewelry, and luxury jewelry can appreciate over time while maintaining intrinsic value. Understanding materials, brands, design, and market trends ensures informed investment decisions.