When discussing silver in the context of coin collecting, it’s essential to understand the difference between sterling silver and pure silver (fine silver). Pure silver refers to silver with a purity of 99.9%, often labeled as .999 silver.

This is the standard used in bullion coins and investment-grade silver bars. Sterling silver, on the other hand, contains 92.5% pure silver and 7.5% of other metals, typically copper to make it more durable and resistant to scratches.

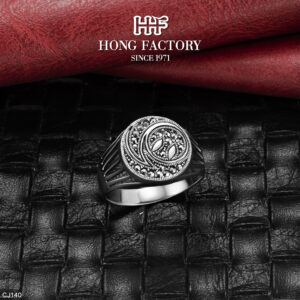

For coin collectors, this difference in composition plays a significant role in determining the value, durability, and appeal of each piece. While both are considered precious metals, their uses and market prices differ significantly. marcasite

Why Collectors Value Pure Silver Coins

Pure silver coins are often minted by government institutions or reputable private mints. These coins carry high intrinsic value due to their metal purity and often serve as investment pieces rather than collectibles. Examples include the American Silver Eagle, Canadian Maple Leaf, and Austrian Philharmonic coins.

Collectors appreciate pure silver coins for several reasons:

- High intrinsic value: The nearly 100% silver content ensures strong value retention.

- Investment potential: Pure silver coins tend to appreciate alongside global silver prices.

- Prestige and trust: Coins from government mints often come with guarantees of purity and weight.

However, pure silver is a soft metal. This means coins made from .999 silver are more prone to scratches and dents, requiring careful handling and storage.

Why Sterling Silver Appears More Affordable

Sterling silver, due to its alloy composition, contains less pure silver by weight compared to fine silver. This lower silver content typically makes it cheaper per gram. Moreover, the inclusion of other metals enhances durability, which appeals to artisans and jewelers who want longevity in their designs.

For coin collectors, sterling silver may appear more affordable because:

- It contains less actual silver.

- It’s often used for commemorative or decorative coins, not bullion or investment coins.

- It has lower resale and melt value compared to pure silver.

While sterling silver coins are often valued more for their craftsmanship or rarity, their metal value is inherently lower.

Is Sterling Silver Cheaper Than Silver for Coin Collectors?

Yes in most cases, sterling silver is cheaper than pure silver for coin collectors. But the difference lies not just in price, but also in purpose and market positioning.

When coin collectors buy pure silver coins, they’re often investing in a tangible asset that tracks global silver prices. The market value is primarily driven by silver’s spot price. Sterling silver, however, is more associated with collectible items limited editions, artistic pieces, or historical medallions where the aesthetic and rarity might influence the cost more than the silver content itself.

In short, while sterling silver is indeed cheaper, it doesn’t hold the same investment appeal for those focused on bullion value. Collectors interested in artistry or limited editions might still favor sterling silver coins, but those looking for long-term value retention tend to prefer pure silver.

Collectibility vs. Investment: What Matters More?

For many coin enthusiasts, collecting is not purely about investment. The artistry, history, and rarity of a coin can often outweigh the importance of metal purity. Sterling silver coins especially those minted for commemorative purposes are often beautifully designed, featuring intricate engravings and limited release numbers.

For example, a limited-edition sterling silver commemorative coin celebrating a historical event might be valued more for its craftsmanship and scarcity than for its metal content. Conversely, a one-ounce fine silver bullion coin’s value is almost entirely tied to the silver market price.

Therefore, the type of collector you are greatly influences which metal suits your interests:

- Investment-oriented collectors: Prefer pure silver coins for their intrinsic and market value.

- Art and history enthusiasts: May enjoy sterling silver coins for their craftsmanship and design value.

Factors That Affect Silver Coin Prices

Beyond metal content, other factors play crucial roles in determining a coin’s value:

- Mint origin: Coins from recognized mints carry higher credibility.

- Year of issue and rarity: Older or limited-issue coins tend to appreciate over time.

- Condition: Graded coins in mint or proof condition hold higher resale value.

- Demand and design: A popular theme or event can increase collectibility.

Understanding these factors helps collectors make informed decisions, regardless of whether they choose sterling or pure silver coins.

Choosing What Fits Your Collection Best

While sterling silver is technically cheaper than pure silver, the choice depends on your collecting goals. If you value long-term investment and purity, pure silver coins are the better choice. If you appreciate craftsmanship, heritage, and artistry, sterling silver coins offer beauty and variety at a more affordable entry point.

Ultimately, both types of silver have their place in the world of coin collecting one as a store of wealth, the other as a celebration of design and culture. The key lies in understanding your priorities and collecting with purpose.